Many consumers are missing out on better deals on their financial products. The Australian Competition and Consumer Commission (ACCC) found low engagement in the retail deposit (e.g. savings accounts) and home loan market (ACCC 2019; 2023).

The Behavioural Economics Team of the Australian Government (BETA) partnered with the Department of the Treasury to:

- understand consumer experiences finding and switching financial products, and in the case of home loans, repricing existing loans

- test prompts designed to encourage consumers to engage with the market or contact their bank to request a reprice.

We conducted research activities including a field trial with an industry partner, randomised controlled trial survey experiments, and consumer interviews and surveys.

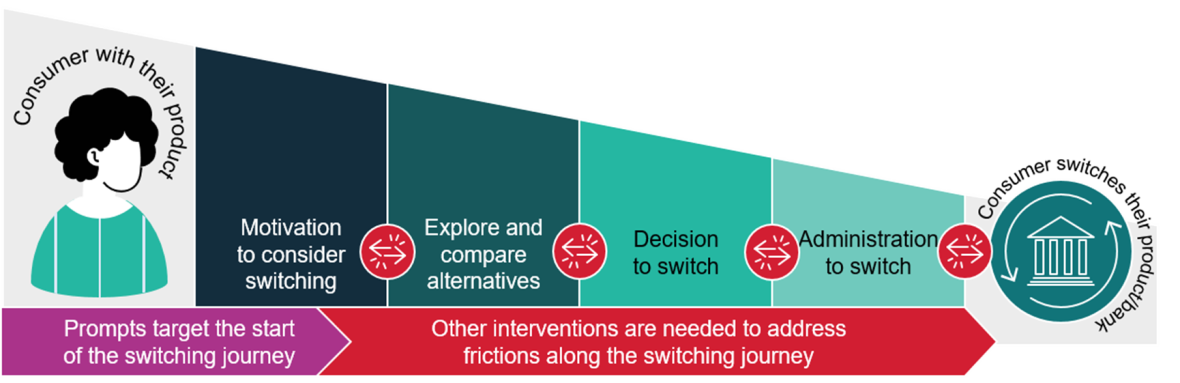

We found that while well-designed prompts may help draw attention to the benefits of switching, there are subsequent frictions (barriers) to getting a better deal, which prompts alone cannot address.

This research supports the raft of initiatives announced by the Treasurer to help consumers get a better deal on their banking products.

Read the full report: Prompting for a better deal: Understanding and overcoming barriers to financial product switching

Prompt design matters

Prompts can be dismissed or overlooked. BETA found effective prompts are:

- prominently placed to capture attention

- personalised to consumers to demonstrate the benefit of switching

Non-personalised prompts with low visibility were not effective in increasing consumer action. As of publication date, we are conducting a second field RCT which makes prompts more prominent and personalised and will share findings once complete.

Given the diversity in consumers, products, banks and other lenders, it is unlikely a ‘one-size-fits-all’ prompt would be appropriate for all consumers. However, prompts adhering to overarching principles, such as those identified, coupled with monitoring of effectiveness may yield positive results.

Prompts alone cannot overcome frictions in the switching journey

Prompts act as a trigger point and encourage market engagement. However, after receiving a prompt, there are many frictions on the often complex and non-linear journey to get a better deal.

We found that the number and complexity of choices make it difficult to identify the best home loan or savings account. Comparing savings accounts had the added difficulty of comparing conditional interest requirements.

High administrative burden, effort and time deters consumers of both products from switching. Interestingly, savings account consumers who had recently opened an account reported that they found it straightforward. Financial costs were an additional deterrent for home loan consumers.

Consumers’ desire to avoid the administrative burden associated with switching, influenced their behaviour. For example, home loan consumers may seek or settle for a reprice to avoid refinancing. Repricing can result in direct consumer savings, but it may also deter consumers from switching home loans and obtaining greater savings. Savings account consumers may keep their existing accounts open to avoid the time and effort required to re-establish common payments or direct debits. This prevents some consumers from fully switching over to new accounts.

Going forward, additional initiatives – beyond prompts – are required to support consumer switching. Further consideration is needed to ensure initiatives are suitable in the current regulatory landscape and based on careful evidence-based design and delivery to achieve the best effect.